Interest rates are on the rise. That is because inflation is at its highest level since the early 1980’s. You know this reality by how much more you have to pay to fill your car with gasoline. It hit me the other day when I had to pay $13 for a hamburger at a local dive. That supposed gourmet burger used to cost $10. But $13!! That gives me pause. I need to change my eating-out and spending habits to combat this assault on my cash.

The Federal Reserve uses a variety of weapons to fight against rising prices and rampant inflation. Their main weapon is to raise interest rates. They’ve done that once already, and have signaled many more rate increases to come. What does this mean to you?

When the Fed raises rates, Banks respond by raising the interest rates they charge on loans. The first loan category that gets hit with that increase is credit cards. Credit card rates are already high. But they are set to skyrocket in this inflationary environment. If you carry any credit card debt, brace yourself.

Why should you be wary? Consider the average credit card scenario. The average balance carried on credit cards is $5,500. If just the minimum required payment is made, at the average 16.3% interest rate, it will take 16 years to pay off and cost over $6000 of interest expense. Think about that. That is an extra $6000 cost for you to enjoy the $5,500 worth of stuff and fun you financed. Could that $6000 be put to better use?

Higher interest rates will only exacerbate this impact. The same calculus is true for student loans and adjustable-rate mortgages and home equity lines. You need a sense of urgency to get rid of this debt. And you need a plan. You could play the game of transferring credit card balances to promotional rate come-ons of zero percent for six months. But it is far better to pay off these balances.

Snowball Your Debt

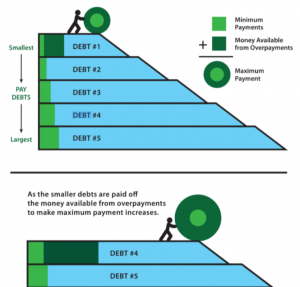

To eliminate debt, financial planning best practice is to employ a strategy commonly called “Snowball your Debt.” The first step is to list your debts from smallest to largest, and include columns for “actual payment” and “minimum payment.” The first objective is to get that smallest debt paid off pronto. Use cash reserves if you have enough. Sell assets if you can. Do everything possible to pay off that smallest debt. Then, apply that debt’s payment to the next smallest balance. Also, pay just the minimum on all the other balances, applying the excess payments to that next smallest debt to get it paid off as soon as possible. When that is accomplished, apply that payment to the next debt, and so on. Here is an illustration of how this strategy works:

Snowballing your debt is a tried-and-true strategy. It is hard work. It demands commitment and discipline. But, it is worth it. And being debt free is Biblical. Proverbs 22:7 says that the borrower is a slave to the lender. No one wants to be a slave. But debt enslaves you by obligating you to pay back the debt – no matter what. So, pay it back and be free. Think about how much better your life will be when you are debt free!

I asked earlier if that $6000 of interest expense could be put to better use. What more could you do to help build God’s kingdom if you were debt free? You could redirect some of those payments to help ministries that serve the poor and the most vulnerable. You then become a participant in their mission. What a great opportunity to be a part of something so impactful.

Time is of the essence. Rates are going higher. Please get serious and take the necessary steps to pay off your consumer debts. There are a few entities that can guide you if you want help developing a plan tailored to your needs. One in particular is Compass Catholic Ministries. They have great resources to help you. Their six-week Bible study Faith and Money Matters will walk you step-by-step along your pathway to financial freedom. Learn more by visiting their website www.compasscatholic.org

#Inflation #RisingInterestRates